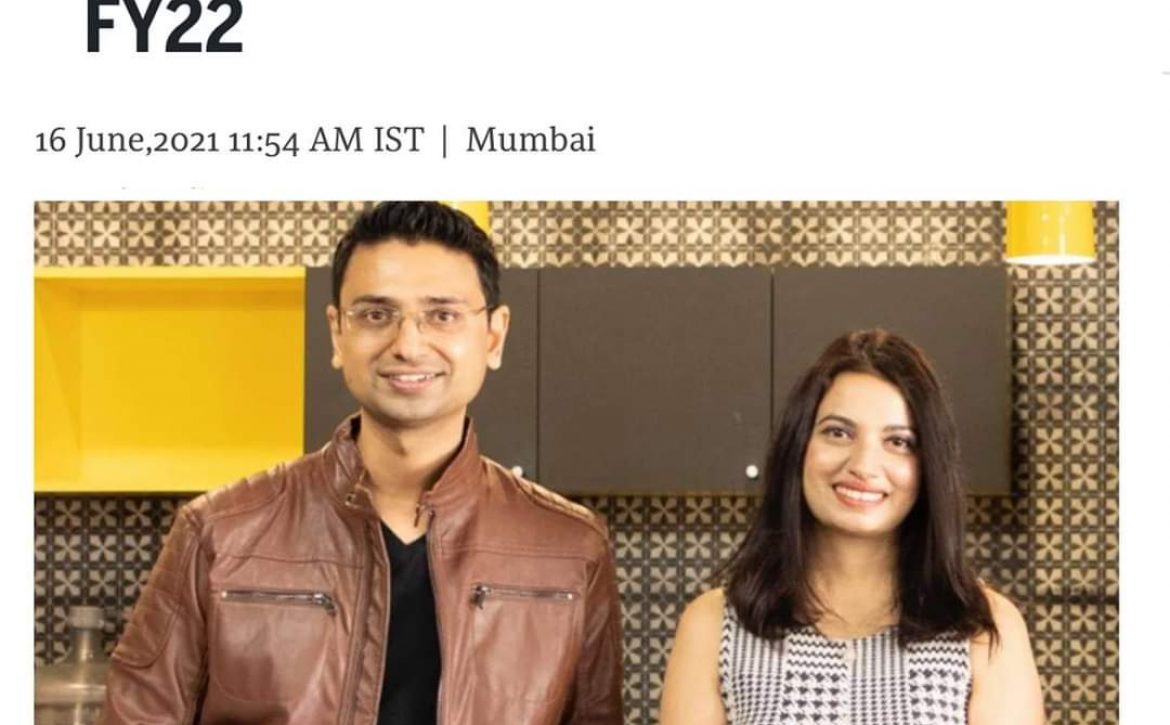

The New Indian Express: The Power Couple Of Tech In Bangalore.

The New Indian Express showcased the accomplished co-founders of GoodWorkLabs, Vishwas Mudagal & Sonia Sharma, in recognition of their status as eminent figures within the tech industry of Bangalore. The article provided insight into their entrepreneurial journey, detailing their growth within the burgeoning startup landscape of India. The article also talks about NetSKill, the latest venture by Vishwas and Sonia built towards creating the next-million-engineers at the grassroot level and help organisations to upskill their talent pool.

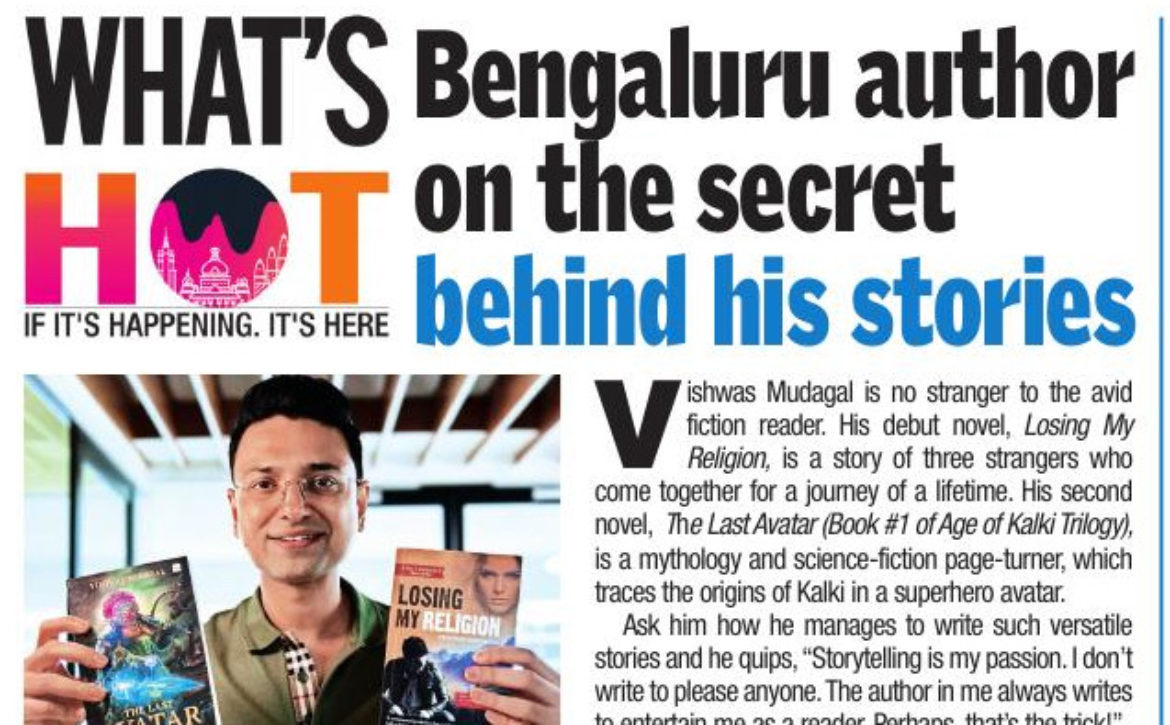

In addition, the article highlighted Vishwas Mudagal’s literary prowess, underscoring his success as the celebrated author of two bestselling books, “Kalki, The Last Avatar” and “Losing My Religion”. Furthermore, the piece captured the impressive growth trajectory of the GoodWorks group of companies, which has expanded its reach from IT services to real estate and VC funding. This remarkable achievement has earned GoodWorkLabs the distinction of being one of the fastest growing companies in India, as attested by the Deloitte Fast50 awards. The article provides an insightful portrayal of the exceptional talents that have propelled the GoodWorkLabs brand to the forefront of the industry.